The lifetime estate tax exemption and planning opportunities

Today, Tahir Mahmood and Laima Zirne sit down with Jamie Spriddle of SRDS Tax to discuss US estate taxes and planning opportunities available for Americans.

What is estate tax?

US estate tax is a federal tax charged on the estate of a US citizen or US domiciliary if their gross estate exceeds the available exemption at the date of death. It is the US equivalent of UK inheritance tax. The 2024 exemption amount is $13.61m, also known as the lifetime gift tax exemption. US estate tax works on a unified basis, if an individual makes significant gifts during their lifetime, those gifts will reduce the available estate tax exemption on death.

US estate tax is charged on the value exceeding the available exemption at graduated rates up to a maximum of 40%.

US gifting rules

There are three main gift tax exclusions and deductions that US individuals should be aware of:

- Gift Tax Annual Exclusion. US persons can gift up to $18,000 (2024 rate) to any number of donees on an annual basis without using up any of their lifetime gift and estate tax exemption. US married couples do have the option of ‘gift splitting’ to combine their individual gift tax exclusion amounts. Transfers exceeding the annual exclusion will reduce their available exemption on death by the excess amount. For example, a 2024 cash gift of $50,000 would reduce an individual’s exemption at death by $32,000. Gifts in excess of the annual exclusion will create a gift tax filing requirement.

- Marital Deduction and Gifts to non-resident alien (NRA) Spouses. The unlimited marital deduction allows a US individual to make unlimited lifetime gifts to their spouse, provided the recipient spouse is a US citizen. In a mixed marriage, a US spouse can gift annually up to $185,000 (2024 rate) to their non-US spouse free of any gift tax.

- Lifetime Gift Tax Exemption. As above, US individuals are entitled to a lifetime gift tax exemption of $13.61m (2024 rate). For a US married couple, a total of $27.22m can be collectively excluded from gift & estate tax. Utilising the lifetime gift tax exemption will reduce the available exemption on death. The exemption amount was significantly increased in 2018 but is due to sunset from 1 January 2026 to pre-2018 levels – expected to be in the region of $7m.

“Sunset” Planning Opportunities

Under the 2017 TCJA (Tax Cuts and Jobs Act) the lifetime estate and gift exemption was nearly double to $11.18 million. This has slowly increased with inflation and for 2024 this currently stands at $13.61 million per individual. The sunset provision takes this back down to the pre-trump levels at the end of 2025.

“Use it or lose it” provision

If the value of a US estate currently exceeds the $13.61m exemption threshold, there is planning that can be done now to take advantage of the increased exemption. The period through to 31 December 2025 is an opportunity for US individuals to assess their US estate tax exposure and explore lifetime gifting strategies to optimise the higher exemption.

The sunset provision will not only impact US estates valued over the current exemption but also those in the region of $7m (expected to be the reduced exemption amount) to $13.61m as those estates will become liable to US estate tax.

Example one – No gifting

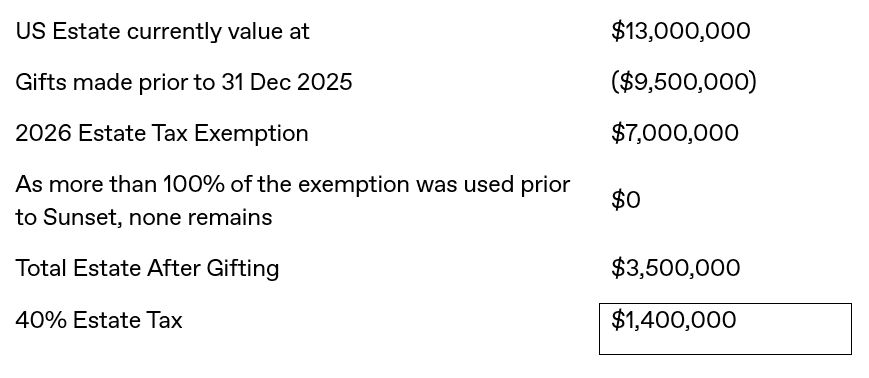

Example two – Gifting prior to the sunset provisions

Importantly, the Internal Revenue Service (IRS) have issued regulations confirming lifetime gifts made during the increased exemption period that exceed the lower 2026 exemption amount will not be clawed back. However, it is a ‘use it or lose it’ provision.

Other Considerations

Qualified Domestic Trust – QDOT

Qualified Domestic Trusts (QDOTs) are useful planning tools that can be utilised to overcome the limited marital deduction in a US/UK mixed marriage. Assets can be passed to a surviving non-US spouse and qualify for the unlimited marital deduction.

The QDOT would be funded upon the death of the US spouse to the extent their estate exceeds the current US estate tax exemption.

QDOTs merely allow for the deferral of the US estate tax charge. The deferred US estate tax crystallises upon the death of the non-US spouse, when the assets pass out of the QDOT.

What is the benefit of the deferral? Upon the death of the non-US spouse, a UK inheritance tax exposure is created on the trust assets. As the US and UK tax positions are triggered at the same point, tax credits between the two jurisdictions would be available to prevent double taxation.

Spousal transfers & the NRA $60,000 Estate tax exemption

Transfers between US citizen spouses benefit from the unlimited marital deduction. Upon one spouse’s passing, their assets pass to the surviving spouse without incurring US estate tax.

As outlined above, the marital deduction does not apply to assets passing to a non-US spouse.

For a non-US spouse inheriting assets below lifetime exemption amount, no US estate tax is due, and the assets pass over free of any estate tax.

US estate tax may be an issue should a US non-resident alien (NRA) passes away owning US situs assets, such as US real property or shares in US companies. The estate tax exemption for NRAs is limited to $60,000.

NRAs owning US property should seek advice as there is planning that can be done to limit their exposure to US estate tax.

For example, US property held within an irrevocable trust, or a non-US corporation, is outside the scope of US estate tax. In both scenarios, advice should be sought before setting up any such structures as suitability will be dependent upon the value, as well as the nature and intended use of the property.

State Level Estate Taxes

Worth noting, like income taxes, every US state reserves the right to impose its own estate tax regime.