Insurance strategic asset allocation, a tool to navigate the investment labyrinth

Investment markets are a labyrinth

We have explored some interesting themes in our journey through Greek mythology (multi-faceted risk, active vs passive for insurance, duration vs convexity for insurers). In this next instalment we introduce another Greek hero, Theseus, who attempts to solve the puzzle of the Labyrinth – something that can be likened to insurance companies trying to navigate investment markets! The Labyrinth was a vast maze, designed by the skilled craftsman Daedalus and built on the Island of Crete. It was commissioned by King Minos of Crete to imprison the Minotaur, a monstrous creature with the body of a man and the head of a bull. Each year, fourteen youths from Greece were sent to Crete to be sacrificed to the Minotaur as a tribute to King Minos; an experience I am sure professionals working in investment and insurance can relate to.

Unfortunately, there are many similarities between this story and the experience of some insurance Board Directors and management teams when it comes to investment. The vast Labyrinth with its network of unclear and opaque paths, dead-ends and a Minotaur roaming around is an apt metaphor for investment markets when decision makers are not equipped with the right strategies and appropriate skills. Without some basic tools, insurance companies, much like the ill-fated youths of Greece, will find themselves aimlessly wondering the markets while being stalked by a formidable foe.

This begs the question how can insurers prepare for this and what tools and strategies are best employed? Let’s take a leaf out of Theseus’ book.

Theseus, ariadne and the ball of thread

Our hero Theseus (son of King Aegeus of Athens) volunteered to be one of the young Athenians sent to Crete; his objective was to end the tribute by slaying the Minotaur. He was helped by Princess Ariadne (daughter to King Minos) who gave him a ball of thread and instructed him to unravel it behind himself as he ventured deeper into the Labyrinth. This was a simple and elegant solution to the problem of finding his way out of the Labyrinth.

For insurers a Strategic Asset Allocation, “SAA”, is a conceptually simple and elegant tool that can be used to navigate investment markets. A SAA, properly incorporated in an Investment Policy Statement and implement through a portfolio of assets, will reflect the central investment objectives and risk/return characteristics of an insurance company (or any other investor). However, a SAA can be a poor navigation tool when constructed in haste, executed poorly and not properly tracked or managed. In our experience, there are a few common challenges insurance companies come across as a result of being misguided by an ill-constructed SAA.

Theseus’ risk review and challenges from a poor saa

We are going to take some poetic license and assume Theseus and Ariadne performed some stress and scenario testing on their idea of using a thread before tackling the Labyrinth. Some of the questions they no doubt asked each other were:

01. WHY AM I, THESEUS, GOING INTO THE LABYRINTH AT ALL?

Theseus was very clear on his objective – to save his fellow Athenians from the Minotaur. Insurers are not always clear on the purpose of their venturing into the market and, by extension, the purpose of their SAA. For most investors the aim of investing is to maximise return whilst minimising risk but this simple idea can quickly become complicated when one considers wider factors insurers need to consider such as asset-liability matching, ESG, regulatory and accounting requirements, access to and understanding of asset classes and so on. An SAA that is constructed without a clear and articulated view on an insurer’s risk appetite, business objectives, macroeconomic outlook,operating environment and ultimately their investment objectives will likely result in sub-optimal outcomes in the long run. The purpose of the SAA is to provide a central thesis governing investment decision hence it is important to take a step back, understand and clearly articulate what the SAA is there to achieve.

02. HOW MUCH THREAD WILL I NEED?

A simple question but an easily overlooked one. For Theseus it would have been difficult to know definitively how much thread he would need to accomplish his task. However, Araidne, no doubt performed some modelling based on the history of the Labyrinth, or some rudimentary analysis to gauge how much string Theseus would need. Perhaps she simply gave him as much string as she had. But what we know is that the assumptions and methodology used for measuring and testing any tool before use is critically important. SAA’s sometimes do not produce expected results because the assumptions about risk, return, correlations and behaviour of asset classes are not thoroughly interrogated and are left untested.

Often insurers unwittingly rely on legacy assumptions about asset classes and their behaviour that become less relevant as markets evolve and the insurer’s business and requirements change. This can quickly result in an SAA that is no longer fit for purpose.

03. WHAT HAPPENS IF I RUN OUT OF THREAD OR SOMETHING ELSE GOES WRONG?

For this scenario, my guess is Theseus planned to follow the thread back to the entrance pick up some more thread and return to his task. Surprisingly often, insurers build an SAA without performing scenario analysis to identify potential weaknesses.

In some cases, scenario and/or shock analysis is performed based on a narrow or immaterial set of risks. A common pitfall for insurers is being led entirely by their investment advisor or asset manager in terms of scenarios to test without questioning whether the scenarios are relevant to them. For example, using asset only shocks and scenarios that do not take into consideration correlation with liabilities or other non-investment factors such as accounting or regulatory implications will not be able to properly inform decision makers. Incorporating non-investment factors into insurance asset management stress-testing is increasingly important.

A poorly considered approach to scenario analysis can provide false confidence in the robustness of the SAA and lead to surprising results when market shocks materialise.

Strengthening the SAA thread

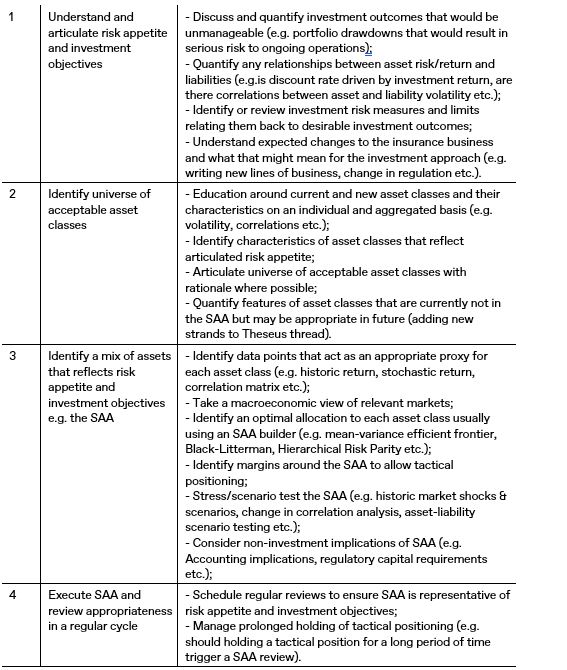

How does one go about carefully constructing, executing, and managing a SAA to ensure it has the right characteristics to navigate investment markets. This will depend on the insurer but in general when we are working with insurers we follow a few key steps:

Applying these principles makes it far more likely that the SAA reflects the features most pertinent to the insurer. This can provide an excellent thread to guide the management team and Board through the challenges of managing an insurer’s investment portfolio.

Did the plan work?

Theseus, of course, emerges victorious, slaying the Minotaur, navigating out of the Labyrinth and saving his people all thanks to Ariadne’s simple idea. Investing for insurance companies may not be as dramatic but the consequences of getting things wrong can be wide-ranging and damaging.

A SAA is a simple tool that can help navigate investment markets by ensuring that investment decision making reflects the features most important to an insurer. Consequently, it is important that insurers take the time to embed features relevant to their business into their SAA. This is not always easily done but a careful and considered approach to building a SAA together with your investment manager is a great way to achieve this.

London and Capital can help

We would advocate building the SAA one string at a time to ensure the entire thread is fit for purpose. L&C has experience building SAA’s for a range of insurance entities covering long and short tail business. Our process covers the entire gambit from articulating risk appetite and objectives, to execution and ongoing management and review of an insurer’s SAA.

We would be glad to help you build a robust and relevant string as you tackle the Labyrinth.