THE CALM INVESTMENT SEA

In our previous instalment, Heracles (or Hercules) had battled the Lernaean Hydra – mirroring insurance companies’ battles against investment risk in various guises. This time we shift to a completely different story; (in my Greco-Roman mythology research I came across this story and thought it was incredibly relevant. So, I ditched Heracles in this instalment of our series, much to the chagrin of my marketing department). The Greeks recount the tale of the Shepherd and the Sea:

A shepherd, keeping watch over his sheep near the shore, saw the Sea very calm and smooth, and longed to make a voyage with a view to commerce. He sold all his flock, invested it in a cargo of dates, and set sail. But a very great tempest came on, and the ship being in danger of sinking, he threw all his merchandise overboard, and barely escaped with his life in the empty ship. Not long afterwards when someone passed by and observed the unruffled calm of the Sea, he interrupted him and said, “It is again in want of dates, and therefore looks quiet.”

When I first read this story, I thought it was a striking metaphor for the tension between active and passive investing for insurance companies. This tension is unique to insurers because factors outside of pure investment return need to be considered when making the choice.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RETURNS…

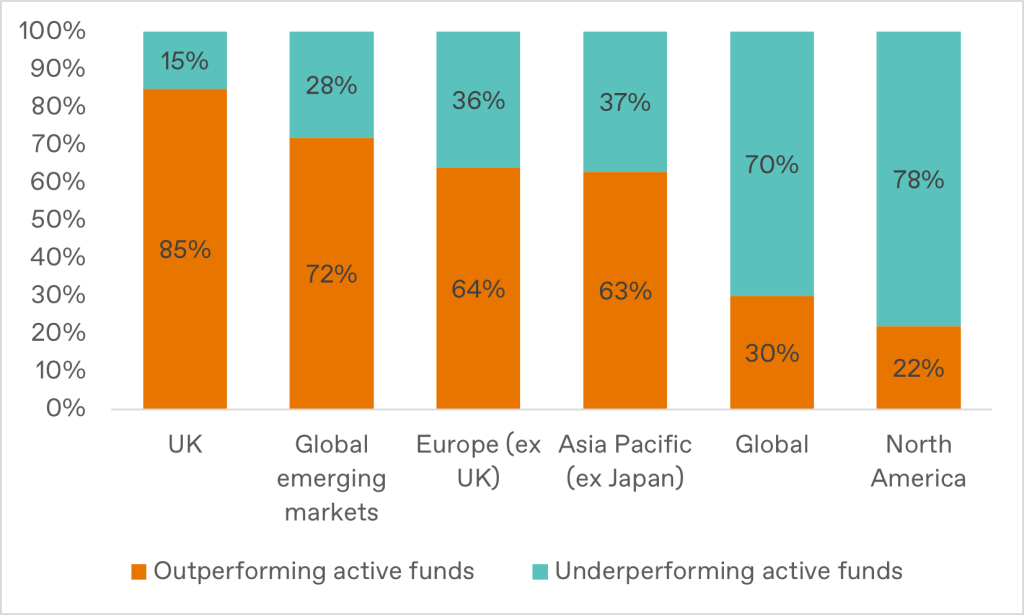

Have investors in passive investment vehicles generally done better than those in active vehicles over the last decade? Deciding one way or another is not necessarily straightforward. According to a UK stockbroker, AJ Bell, a big determiner of out-performance is the geography of the market.

Source: AJ Bell Jan 2011 – Dec 2021

As shown in the chart above, the last decade has seen a ‘rising tide’ but one that hasn’t ‘lifted all boats’. Outperformance in markets like the US with companies that are in vogue and have disproportionate market capitalisation (I am looking at you tech stocks), has been extremely difficult for active managers. We have also had a period where volatilities have been subdued by monetary policy resulting in what has looked like very calm seas with huge potential for trade.

Passive strategies also benefit from a fair wind at their sails – the momentum effect. That is, as passive strategies increase in popularity, valuations of assets held in the largest passive funds increase as investor funds are pumped into the passive ecosystem (i.e. the largest companies in the S&P 500 Index). These valuations may not necessarily reflect the fundamentals, but rather reflect the popularity of the passive investment strategy. However, this momentum effect also works in reverse; disproportionately hurting passive investors when markets are falling, as we have seen over the last 18 months.

Some shepherds of insurance assets have come into this environment, observed the calm sea, and legitimately wondered; what great profits lie on the other side. Selling low-yielding bonds and loading up on passive equity strategies or risk assets more broadly was a tempting proposition over the past decade. But like the shepherd in our story, investors in the past few years have been buffeted by one of the most volatile markets in living memory, impacting all assets classes. Insurers will have found this newly arrived volatility especially painful given many of their underwriting businesses have also come under significant pressure.

At the risk of losing our ‘cargo of dates’ overboard, what are the factors that insurers should consider before setting sail, on either an active or passive voyage.

ACTIVE VS PASSIVE CONSIDERATIONS FOR INSURERS

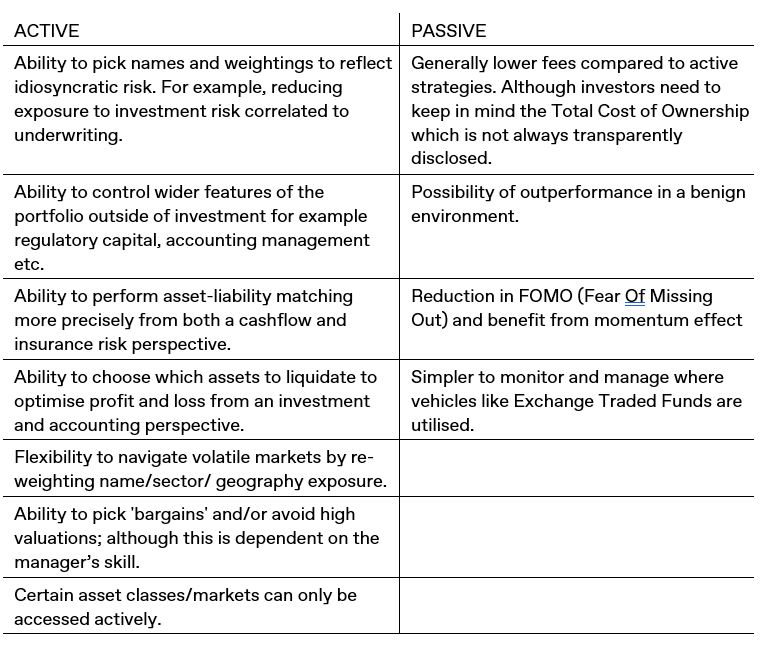

The first place to start is to summarise some of the key features of both strategies that are particularly relevant to insurance companies:

Active strategies provide insurers with more flexibility, particularly when it comes to taking and managing investment risk, operational risk, and underwriting risk. Passive strategies arguably provide cheaper exposure to broad asset classes (although net of fees returns is probably a better measure of value rather than absolute fee levels) and possibly reduce the administrative burden around investing. Outperformance of one strategy over the other will depend on several factors including fees, size of mandate, features of the target investment market and wider economic and investment style factors.

In volatile markets, an active approach provides some additional benefits for insurers. An active investment manager can help an insurer navigate volatile markets by:

- Distilling a view as to the sources of market volatility.

- Identifying asset classes that should outperform given the environment.

- Identify sectors and names that would benefit or suffer given the environment.

- Actively manage risk on a day-to-day basis as volatility ebbs and flows.

For insurers there are also some logistical efficiencies in favour of an active approach during times of market stress:

- Efficiently manage liquidity by identifying assets to liquidate to meet liability requirements (as opposed to selling all assets equally).

- Match assets with liabilities more effectively.

- Better reflect areas of particular interest for example by building bespoke ESG portfolios to manage or mitigate identified ESG risks in both assets and liabilities.

The choice of whether to go active or passive will depend on an insurer’s sensitivity to many of the factors above, the target asset classes, risk appetite and overall business and investment objectives. Assuming that either an active or passive strategy is appropriate for an insurer without understanding the specific business and investment objectives is like leaving port without a charted course.

“IT IS AGAIN IN WANT OF DATES, AND THEREFORE LOOKS QUIET”

It is a common mistake, repeated time and time again by institutional investors, to assume a seemingly ‘safe’ strategy that has been successful in the past will continue to work as market conditions change. Especially if the only factor being taken into consideration is investment risk and return. Just look at the subprime mortgage scandal in the US from the mid-2000’s or even the more recent LDI pension crisis in the UK.

What’s more, insurers are unlike many other investors in that their investment portfolios need to do more than simply generate a return. Insurers rely on their investment portfolios for economic, regulatory, and accounting stability. These factors are difficult to juggle at the best of times (see our Heracles and the Lernaean Hydra article for more details) and following the herd blindly into the most popular strategy of the day will almost certainly create imbalance between the portfolio and your business objectives. Calm benign markets can be a harbinger of tumult to come, and this has certainly been the case for the market we find ourselves in today. Whether allocating to active, passive or even blend the two strategies is a decision that requires deeper consideration than merely chasing the economic return from the latest trading opportunity, as the Shepherd did.

We would encourage insurers to work with their investment teams to understand the implications for active versus passive investing considering their overall objectives. We have experience working with insurers to help them think through the implications of an active, passive or hybrid strategy. We’ve also been able to successfully execute strategies that both meet their investment objectives and help them manage wider business risks. Please get in touch on the contact details below if we can be of help as you navigate the changing economic seas.