The thought of moving to a new country can be daunting. Taxes and finances are probably at the bottom of most people’s thoughts when they are dealing with a new job, new house and moving away from friends and family.

In this edition of the Roadmap, Tahir Mahmood looks at the current UK tax landscape and some key areas which need to be reviewed prior to your move to the UK.

The Current UK Tax Landscape:

The United Kingdom has a complex tax system that relies on an individual’s residence status, as determined by the Statutory Residence Test, during the UK tax year, which runs from the 6th of April to the following 5th of April. Here’s a summary of some key aspects of the UK tax system and how it differs from the US:

- Tax Year – Unlike most countries which run on a calendar tax year, the UK is slightly awkward and runs from the 6th April to the following 5th April.

- Income Tax: Both the UK and the US impose income tax on individuals. Both jurisdictions run progressive systems based on your level of earnings with the UK having a higher top rate currently at 45%.

- Filing Status – In the UK, individuals file their tax returns as individual taxpayers. Each person reports their own income and pays taxes based on their individual circumstances. There is no equivalent to the U.S. “Married Filing Jointly” (MFJ) status in the UK. Spouses or partners are assessed separately for tax purposes.

- Capital Gains Tax (CGT): The UK and the US both tax capital gains, but there are differences in the rates and exemptions. An important point to note here is that the UK does not differentiate between short and long term. And even more importantly it only looks at the GBP implications of sales.

- Dividend Tax: In the UK, dividends are subject to tax, and there are different tax rates for dividends depending on the individual’s total income. In the US, dividends can be subject to both federal and state taxes, and the rates vary.

Are there any beneficial non-dom regimes?

Yes. To complicate matters even further, there is a non-dom regime in the UK called the remittance basis of taxation. This allows individuals who have moved to the UK to be taxed in a beneficial way:

- Any non-UK income and gains are only taxable when they are remitted (brought) into the UK.

- The remittance basis can be applied for up to 15 out of 20 tax years. In most situations after that you will be considered deemed domiciled.

- Electing for the remittance basis can result in the loss of the UK personal allowance and other tax benefits.

- There are complex rules governing what can be remitted to the UK without incurring tax, including the “clean capital” and “mixed fund” rules. Which we look at in further detail below.

I have a us brokerage account, is it best for me to just claim the remittance basis?

Unfortunately, this isn’t a straight yes or no. Claiming the remittance basis means the UK will not tax the offshore brokerage account unless remitted to the UK. Normally this is fine, but if those funds are eventually required in the UK there can be a mismatch of credits and potential double taxation.

Our advice here is to seek tax advice. The team at London & Capital can give you guidance and point you in the right direction to get the specialist advice you need.

Should i set up an account in the UK before i move?

Having your account structured correctly before arriving to the UK is probably the number one tip to take away from this article. People generally don’t do this as they are unaware of the UK rules, but on arrival and becoming UK resident, this can pull all of your legacy gains and non-compliant funds into a new world of UK taxation.

Each client has their own set of specific circumstances, and we structure accounts accordingly. For a US citizen who has recently arrived in the UK with a clean pot of pre arrival cash this may be how we structure:

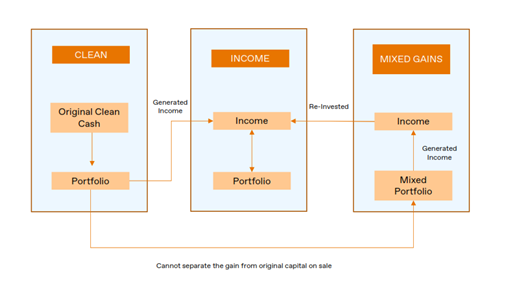

Clean Capital Account: This account is designated for funds that have a clear and traceable history, often referred to as “clean capital.” These funds can be brought into the UK without immediate tax implications. The clean capital account may include:

- Savings from before the individual’s arrival in the UK.

- Inheritance or gifts received with proper documentation.

- Proceeds from the sale of assets acquired before becoming a UK resident.

Funds in this account can be brought into the UK without further tax implications.

Income Account: This account is specifically designated for income received on the portfolio while residing in the UK and has not had UK tax paid on it.

Funds in this account should be brought into the UK last, as they are untaxed from a UK perspective, they may be considered a remittance and potentially double taxed.

Mixed Gains Account: This account is specifically set up to transfer assets from the clean account which are being sold at a GBP gain.

The funds within this account must be meticulously managed to trace the origin of each deposit. If funds are needed in the UK, they should be withdrawn from this account once the clean capital has been exhausted.

Bringing funds into the UK: The clean capital account is usually the most straightforward, as funds in this account can generally be used for any purpose without immediate UK tax consequences. The mixed gains account requires careful tracking of the sources of funds to ensure accurate tax reporting. It’s important to consult with tax advisors to determine the tax treatment of different types of income and gains.