Today, Maryam Lokhandwala, Financial Planner at London & Capital, talks about the basics of National Insurance (NI) and how catch-up contributions could help you.

How do National Insurance Contributions affect my state pension?

To qualify for the full state pension, which is currently £221.40 per week, most of us will typically need to have made contributions for 35 years. These are called ‘qualifying years’. Any contributions beyond the 35 year mark do not result in an increased pension.

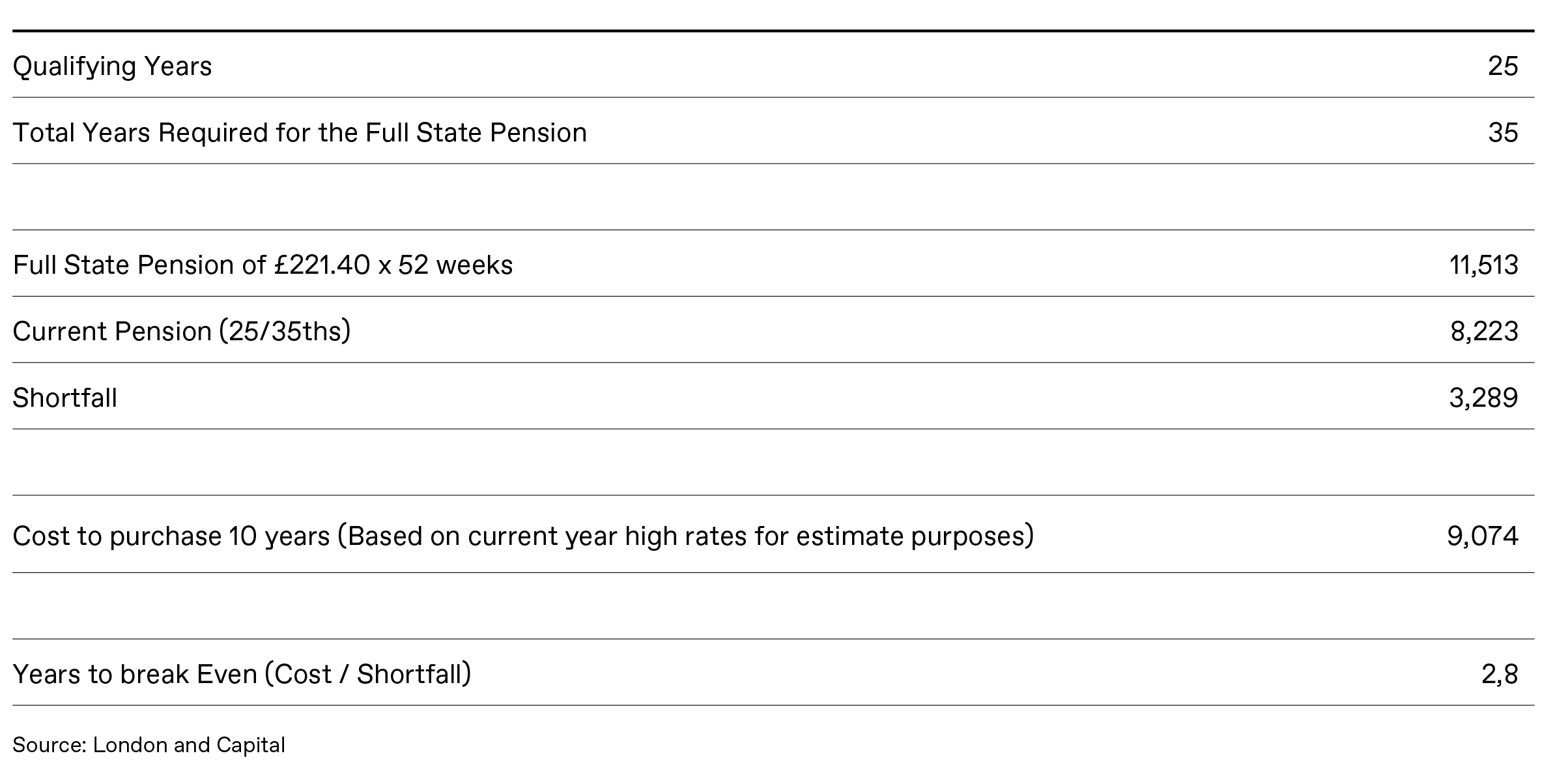

It’s common for people to have missed some years due to illness, taking time off work to raise kids, or being self-employed. If that happens, it could mean receiving a smaller state pension when you retire. Missed years of contribution are pro-rated down, for example, someone with 25 qualifying years would receive 25/35ths of the full pension.

It’s also important to note that if you have less than 10 qualifying years you are not entitled to the state pension at all.

What is the current opportunity?

The government has said:

“If you’re a man born after 5 April 1951 or a woman born after 5 April 1953, you have until 5 April 2025 to pay voluntary contributions to make up for gaps between tax years April 2006 and April 2016.”

After April 2025, you cannot make these additional contributions and you are limited to the last 6 years only.

How much will it cost to fill in gaps in your contributions record?

Buying ‘Class 3’ (Voluntary National Insurance) payments will cost different amounts according on how long ago the gaps in your record happened.

In the 2024-25 tax year, purchasing a week’s worth of missing contributions will cost £17.45, this equates to £907.40 for a full year.

If you need to address gaps from the previous two tax years, you will be charged the rates that apply to those years. The rate for 2023-24 tax year was £17.45 per week. Voluntary payments for gaps in 2022-23 were set at £15.85 per week.

Is it worth it?

It depends. Your health and lifespan are the main aspects to consider here. Taking the example below, this individual is short 10 years of contributions. They are missing out on £3,289 a year in pension and to boost this to the full amount will cost £9,074. Which is just under 3 years to break even.

Where do I start?

Those individuals that have already reached State Pension Age and have found they have missing years can also take action. Visit Check your State Pension forecast – GOV.UK (www.gov.uk) and Check your National Insurance record – GOV.UK (www.gov.uk). You’ll need to log into your Government Gateway account to access your records.

When you get a letter that outlines your pension amount, you can check if paying for those years will lead to a higher pension when you’re older.

Your retirement can be impacted by various elements, such as your age, earnings, existing savings and investments. It’s crucial to seek expert guidance before deciding to make voluntary national insurance contributions or adjusting your pension arrangements. If you require further information, please do not hesitate to get in touch.