As central banks continue to try and tame inflation by tightening financial conditions, interest rates around the world are at the highest level since the 08’ financial crisis. As such, bond yields rose sharply as sovereign rates climbed higher and now investment grade bonds offer yields not seen for over a decade.

This presents a compelling opportunity to invest in eligible Qualifying Corporate Bonds (QCB’s), these offer a tax efficient return well in excess of most bank deposit rates net of tax.

What are Qualifying Corporate Bonds (QCB’s)?

A corporate bond is classified as a QCB if it meets specific criteria set out by HMRC and, if met, any capital gains realised from disposing the corporate bond would not be subject to UK capital gains. The income generated from corporate bond coupons would however be subject to UK income tax. This same taxation rule also applies to UK government bonds (also known as Gilts).

What criteria does a corporate bond need to meet to be classified as a QCB?

- It is in sterling and has no rights of conversion into, or redemption in, a currency other than sterling.

- It has no rights of conversion to certain shares or other securities, and no rights to subscribe for additional shares or securities.

- The interest paid must not exceed a reasonable commercial return, nor depend on the results of all or part of the issuer’s business.

- It is either redeemable at par or on terms comparable with the terms of similar listed securities.

Why are QCB’s so attractive right now?

Due to the sharp increase in interest rates, there is still a large selection of both existing government and corporate bonds with low coupons, now trading well below par to reflect the current yield environment.

By selecting QCBs or Gilts with low coupons, the taxable income is minimised while the tax-free capital gains portion of the return is maximised.

Cash savings vs investing in bonds

UK PEOPLE

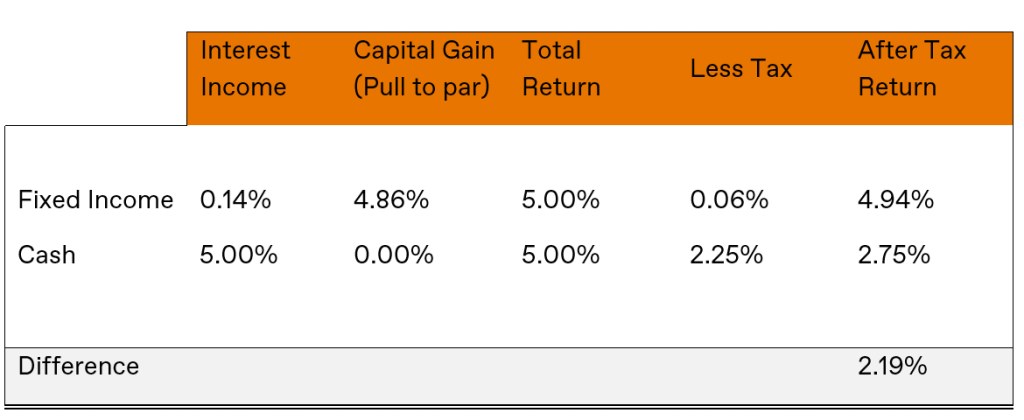

There is currently a large gap between capital gains tax (20%) and the top rate of income tax (45%). By pushing more of the return in capital gains bracket there is an immediate saving of 25%.This is compounded even further by investing in QCB’s which have a 0% tax on gains, giving a total saving of 45% on your net return.

Due to the high rates of cash savings, investors are weighing up the difference between a bond portfolio and holding cash. The after-tax return is the number that really needs to be looked at:

UK/US PERSONS

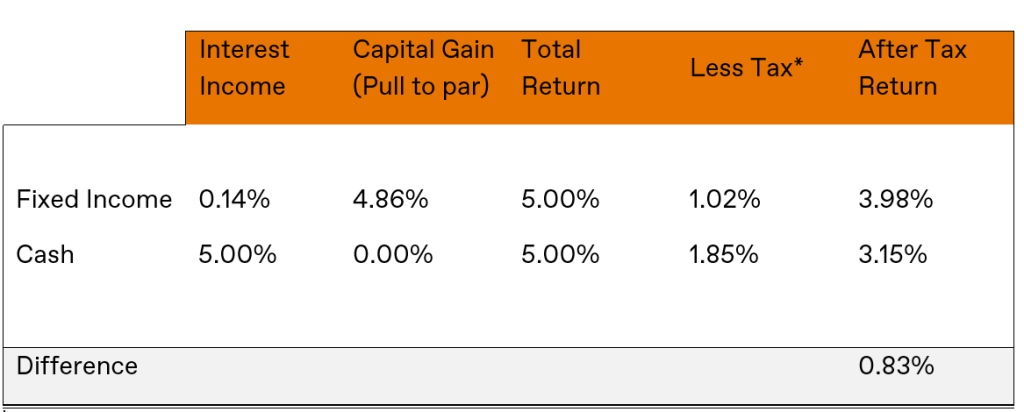

Although not eligible to qualify for the tax advantages of QCBs, US persons are able to capitalise on the higher yields currently offered in the market. Capital gains are taxed at a lower rate than income (20% capital gains vs 37% income for higher taxpayers).

Another factor that US taxpayers will need to consider is the subject of short-term vs long term tax. Short term tax is applied to assets held and sold within a 12-month period (and taxed at the income rate i.e., 37% for higher rate payers), whereas long term assets are those held over 12 months and are taxed at the capital gains rate of 20%.

With these complexities, careful consideration will need to be given to the type of asset and the holding period of the instrument. Here at London & Capital, we would look to hold fixed income in the relevant currency, in the instruments that provide most of their return in the form of capital gains. We look to hold our fixed income instruments for at least 12 months and often longer, which ensures the lower tax rate i.e., the capital gains rate will be applied upon any sales.

*Income tax at 37% and capital gains at 20% long term

What type of fixed income do we buy?

London & Capital focuses specifically on high quality investment grade and government bonds for this strategy to ensure credit risk and price volatility is low. The most attractive QCB yields are currently found in the short-dated area of the market with 1-3yrs being the sweet spot.

Unlike fixed deposits with banks, these bonds can be bought and sold in the market at any time and do not have a lock up or minimum holding period. This liquidity offers clients great flexibility to benefit from attractive net of tax yields while still providing the optionality to liquidate the portfolio should cash be required.

London & Capital has proven experience in running fixed income mandates for private and institutional clients. With our expertise in investment management combined with tax planning proficiency, we can offer attractive tax efficient QCB portfolios to our clients.