Navigating the world of investments can be overwhelming, especially for new investors. In this article, we will explain what bonds are, their place in the capital structure, how they generate income, and how to evaluate their returns.

Basic Terminology

What is a Bond?

A bond is a debt security issued by entities such as corporations or governments to raise capital. When you purchase a bond, you are essentially lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value (principal) at maturity. Bonds are considered fixed-income securities because they provide regular (fixed) interest payments.

How do Bonds Pay Income?

Bonds pay income through interest payments, known as coupon payments, which are typically made semi-annually but can be made annually or quarterly depending on the issue.

The coupon rate is the annual interest rate paid on the bond’s face value. For example, a bond with a $1,000 face value and a 5% coupon rate will pay $50 in interest annually, usually in two $25 instalments.

Accrued Interest?

When purchasing a bond between coupon dates, you will need to purchase accrued interest. This is the interest that has accumulated on a bond since the last interest payment. You will pay the seller the bond’s price plus the accrued interest up to that point. When the next coupon payment is made, you receive the full amount. Accrued interest ensures that the bond seller receives compensation for the period they held the bond and earned interest.

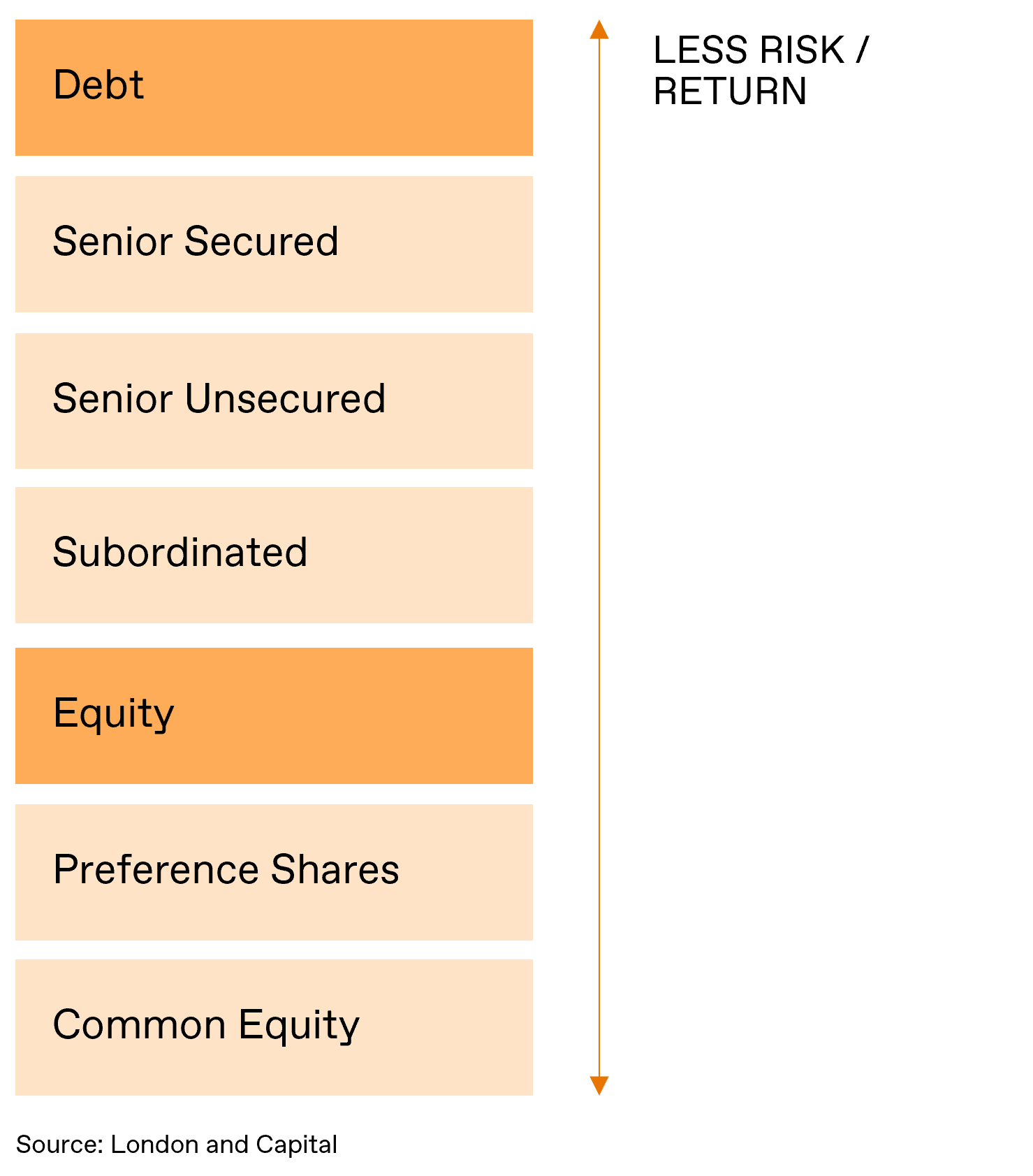

What is the Capital Structure?

Capital structure refers to a company’s mix of capital – its debt and equity. Equity is a company’s common and preferred stock plus retained earnings. Debt typically includes short-term borrowing, long-term debt, and a portion of the principal. In the event of a liquidation, those higher up the capital structure are paid first, with common equity holder being paid last.

Duration

Duration is a crucial concept in the realm of fixed-income investments. It measures the sensitivity of a bond’s price to a given change in interest rates. The higher the duration, the more sensitive the bond’s price is to shifts in interest rates.

Credit Spreads

Bonds not issued by governments will also have a credit spread. This is the difference in yield between a bond and a risk-free benchmark bond, such as a U.S. Treasury bond. This spread compensates investors for the additional risk of default associated with the bond issuer. Higher credit spreads indicate higher perceived risk. For instance, a corporate bond will typically have a higher yield than a similar Treasury bond because it carries a higher risk of default. The difference in the yield between the corporate bond and similar treasury is the credit spread.

Assessing Returns: Yield to Maturity (YTM)

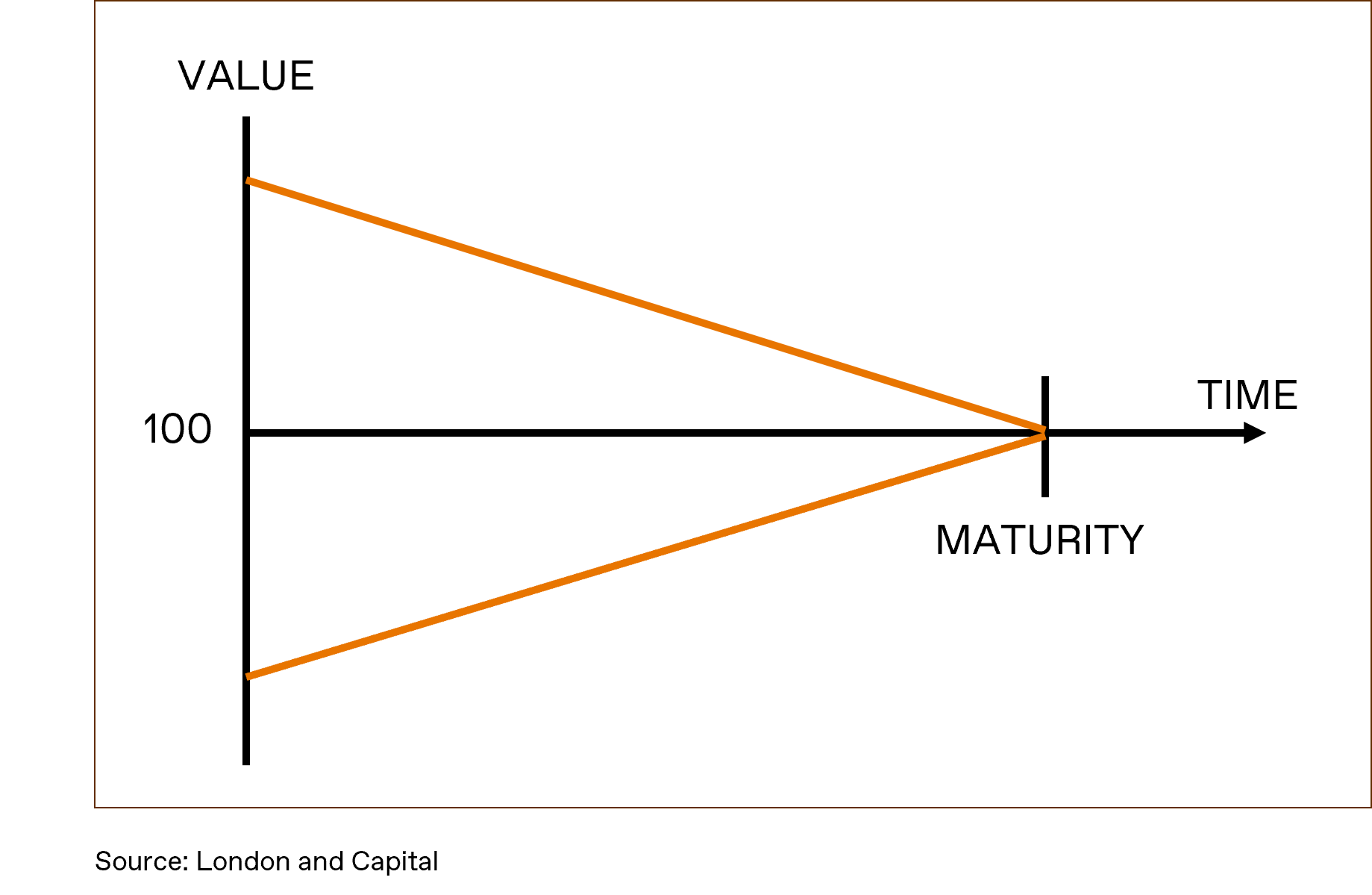

YTM represents the total return an investor can expect if the bond is held until it matures, considering the current market price, the coupon payments, and the difference between the purchase price and the face value or par value. YTM is expressed as an annual percentage rate and is a comprehensive measure of a bond’s profitability. As a bond approaches its maturity date, the value of the bond will move closer to its face value.

This diagram is a simplified model for illustrative purposes. Fixed income securities will not move in a linear fashion to par; the price will be impacted by other factors such as interest rates movements and credit risk.

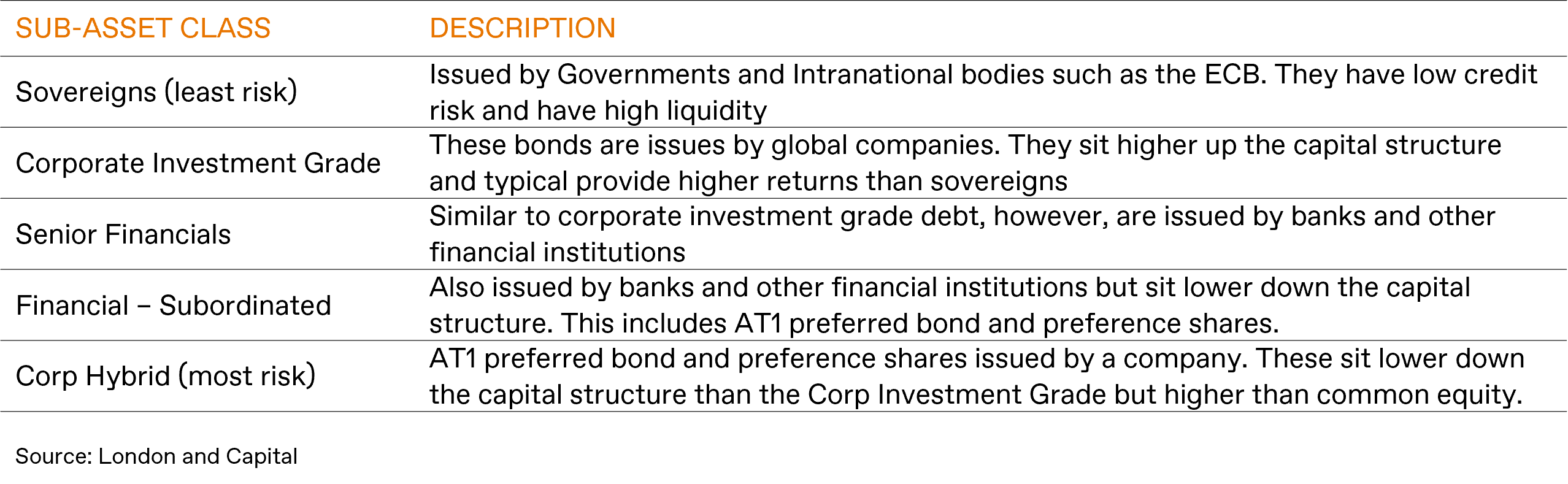

Different types of Fixed Income products

Within the realm of fixed-income investments, there are various types of debt instruments, each with its own level of risk and return. As you move down, the capital structure risk increases, however, so does potential returns.

At London & Capital, we utilise all levels of the capital structure when constructing our client portfolios.

Example of a typical bond

Example – Apple 1.4% 05/08/2028

Using Apple 1.4% 2028 as an example. If we were to buy $10,000 nominal of this bond on 14/06/2024 at a price of $88.44. We would pay $8,844 for the security. We would also need to pay the previous bond holder 130 days’ worth of accrued interest, $50 dollars in this case. The total cost of the bond would therefore be $8,894.

The bond will mature at a value of $100 on the 5th of August 2028 and proceeds received on this day will be $10,000. We will receive a coupon of $70 on the 5th of August and 5th February every year until maturity. This bond would pay $630 in interest payment and appreciate by $1,156. The total return of the bond would therefore be 20.1% if held to maturity. Annualising this figure gives an approximate YTM of 4.5%.