Navigating the world of investments can be overwhelming, especially for new investors.

In this article, we will explain what equities are, the benefits and risks of investing in them, how they generate a return, and outline the different equity strategies that exist.

Basic Terminology

What is an Equity?

An equity security represents a shareholder’s ownership interest in an entity (such as a company, partnership, or trust) through shares of capital stock, which can include both common and preferred shares.

What does owning an Equity mean?

Equity securities grant the holder proportional control of the company through voting rights. In the event of bankruptcy, shareholders share in the residual interest only after all debts to creditors have been settled.

How do I make a return investing in Equities?

Owners of equity securities usually do not receive regular payments, although dividends are often distributed. However, they can benefit from capital gains when selling the securities, provided their value has increased.

Is investing in Equities risky?

All investments carry some level of risk. Stocks, bonds, mutual funds, and Exchange-Traded Funds (ETFs) can lose value if market conditions worsen.

When you invest, you decide how to allocate your financial assets. The value of your investments can increase or decrease due to market conditions or corporate decisions, such as expanding into new business areas or merging with another company.

Diversification is one of the biggest tools investors use to manage their risk investing in specific areas of the market. Different types of equities behave differently in various market conditions.

The main risks investors consider are:

- Market Risk

- Company-Specific Risk (Idiosyncratic Risk)

- Sector Risk

- Currency Risk

- Liquidity Risk

- Interest Rate Risk

- Event Risk

Why invest in equities?

Historically, stocks have outperformed most other investments over the long term. Over time, financial events and economic crises have triggered stock market crashes. Despite these downturns, stock prices typically recover and trend upward. Exiting the market based on short-term factors can cause investors to overlook potential long-term gains. Therefore, the key to successful equity investments is to begin early and remain committed to your strategy.

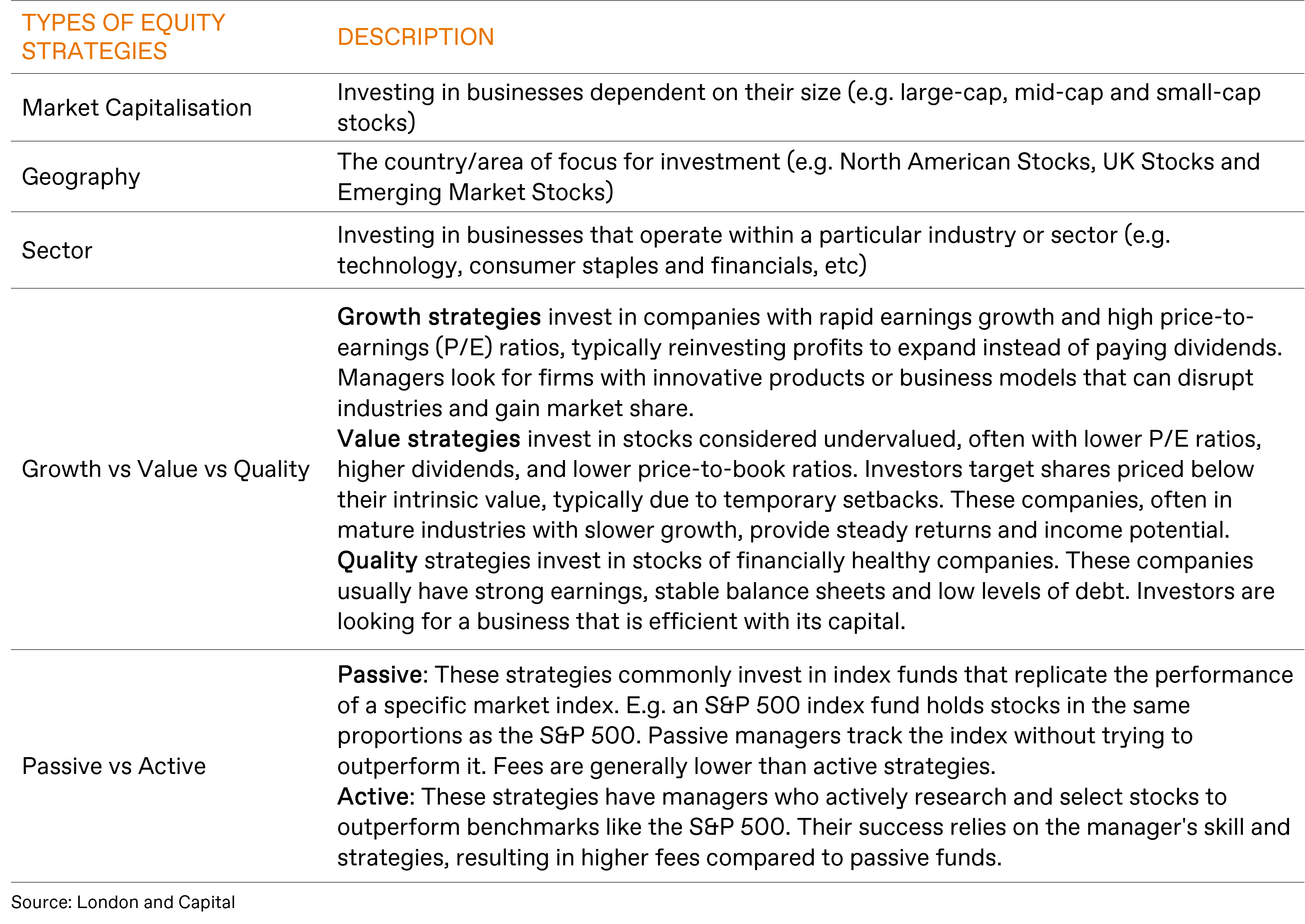

What type of equity strategies are there?

Equities are usually managed as part of a strategy that focus on a specific factor. Below, we have outlined a few examples of the most common equity strategy types.

What is the difference between Public and Private Equity?

Public equity refers to shares of ownership in a company that are traded on a public stock exchange, such as the New York Stock Exchange (NYSE) or NASDAQ. Investors can buy and sell these shares freely through the exchange. When a business decides to go public for the first time it undertakes an Initial Public Offering (IPO), which allows it to offer its shares at a certain valuation point to the public markets. After this, the public equity will be traded on the stock exchange for investors to buy and sell.

Private equity, on the other hand, involves investments in companies that are not publicly traded. These investments are typically made by private equity firms or accredited investors directly into private companies or through buyouts of public companies to take them private. Private equity investments are not traded on public exchanges and are generally illiquid, meaning they are held for longer periods before being sold or exited.

In summary, the key differences between public and private equity lie in their market accessibility, liquidity, and the types of investors involved. Public equity is traded on public exchanges and accessible to a wide range of investors, while private equity involves investments in companies not traded publicly and is typically restricted to private equity firms and accredited investors.