A major life event such a divorce is often the catalyst for re-evaluation of future financial needs, and cashflow forecasts are undoubtedly one of the more valuable tools to do this. When well executed, they can offer reassurance about sustainable levels of spending and that someone is unlikely to run out of money, but inaccurate forecasts can lull someone into a false sense of security leading to complacency and overspending. Planning your financial future can be a daunting task at the best of times – but especially when many areas of your life will have changed and you are unsure of future spending patterns and lifestyle costs.

It is here where cashflow modelling is crucial: it helps to give a holistic view on someone’s finances, while making clients feel more engaged with the advice process. Crucially, it gives guidance that influence financial behaviour and spending patterns.

Why do you need cashflow modelling?

Cashflow modelling is a comprehensive overview of an individual’s assets, liabilities, income and expenditure projected over time. This helps evaluate the individual’s ability to cover future financial needs and objectives. It uses a series of assumptions from aspects such as inflation and growth to future income and tax considerations. From here, individuals or families can consider questions, including:

- Is my spending sustainable?

- How do I achieve my financial goals like buying a second home, paying off debt or gifting money to relatives?

- What happens on retirement? When can I retire with my desired lifestyle?

- How does my investment strategy handle incidents of significant loss?

- Where should I choose to take income from?

A wealth manager can then combine the cashflow modelling with investment objectives and create an investment strategy suited to each person’s needs.

As with all models that extend into the future, these assumptions must be continually adapted to ensure they still reflect real life. We recommend a full review at least every couple of years, and certainly after a major life event such a marriage or divorce. A good cashflow model can enable families to build a picture of how their wealth will develop over time and the options this may provide for them.

Some of the most common challenges when modelling cashflow

Inflation not factored in

Inflation can truly erode wealth. By not increasing the projected expenditure in line with a base level of inflation almost guarantees that purchasing power won’t be maintained into the future. The Bank of England’s inflation target is 2%; we recommend using this as a minimum figure when modelling inflation into cashflow.

Use realistic expectations for asset classes

With interest rates still remaining low, asset class return expectations are likely to remain low as well. If expectations are overstated, then the cashflow model is going to show unrealistic levels of possible spending.

Introducing stress tests

While we hope not to see dramatic market crashes very often, they do happen. In order to make the cashflow model as robust as possible, factor in a 10% fall every 10 years.

Not using accurate expenditure figures

This is probably self-evident, but if a client understates their spending requirements and consistently takes more income than expected, the cashflow model will be inaccurate.

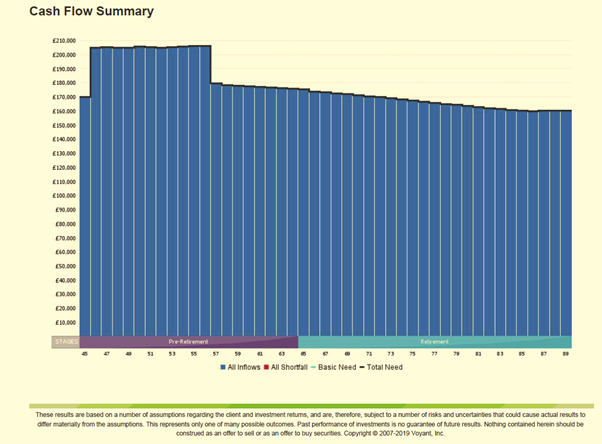

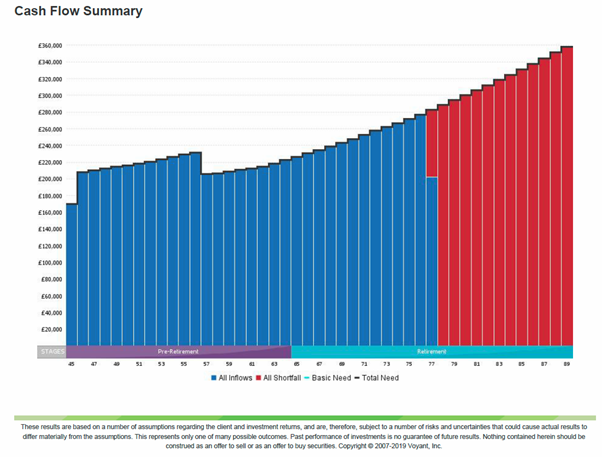

To illustrate the point, the below charts show the different outcomes when the above are not factored in: Angela has received a divorce settlement of £4 million. She has initial spending requirements of £170,000 (including university fees for some years for her children Amy and Jack)

Diagram A

This diagram (A) shows what her cash flow would look like if her spending requirements are not linked to inflation, her portfolio were to return 6% per year gross of charges and there were no market downturns. It shows her spending can easily be maintained at this level for the rest of her life.

Diagram B

This diagram (B) shows a more robust cash flow model including inflation linked spending at 2.5%, university fees increasing at a rate of 3% per year, a 15% market downturn every 10 years and a portfolio return of 5% gross of fees. In this scenario, despite a £4 million settlement, if she continued to spend at this level, Angela would run out of money at age 77.

For further guidance on cashflow forecasting, contact jessica.crane@londonandcapital.com