The UK Government has recently outlined the concept of the inheritance tax (IHT) tail. While initial speculation suggested a sudden cutoff after 10 years of non-residency, it has been clarified that the reduction will follow a gradual taper, depending on the duration of time spent in the UK.

What is the Tax Tail?

Upon becoming non-resident, individuals generally fall outside the scope of UK Income Tax. However, IHT obligations may persist for a period, influenced by the length of prior UK residency. This extended exposure to IHT is commonly referred to as the “tax tail.”

What are the current rules Up To 6 April 2025:

Non-domiciled individuals (UK residents for less than 15 out of 20 years) will not have an Inheritance Tax tail if they leave the UK before 6th April 2025. Once they leave the UK, their non-UK assets immediately fall outside the scope of UK IHT.

Individuals who are either domiciled at birth or deemed domiciled will continue being subject to UK IHT on worldwide assets for 3 years from when they leave the UK.

New Rules From 6 April 2025:

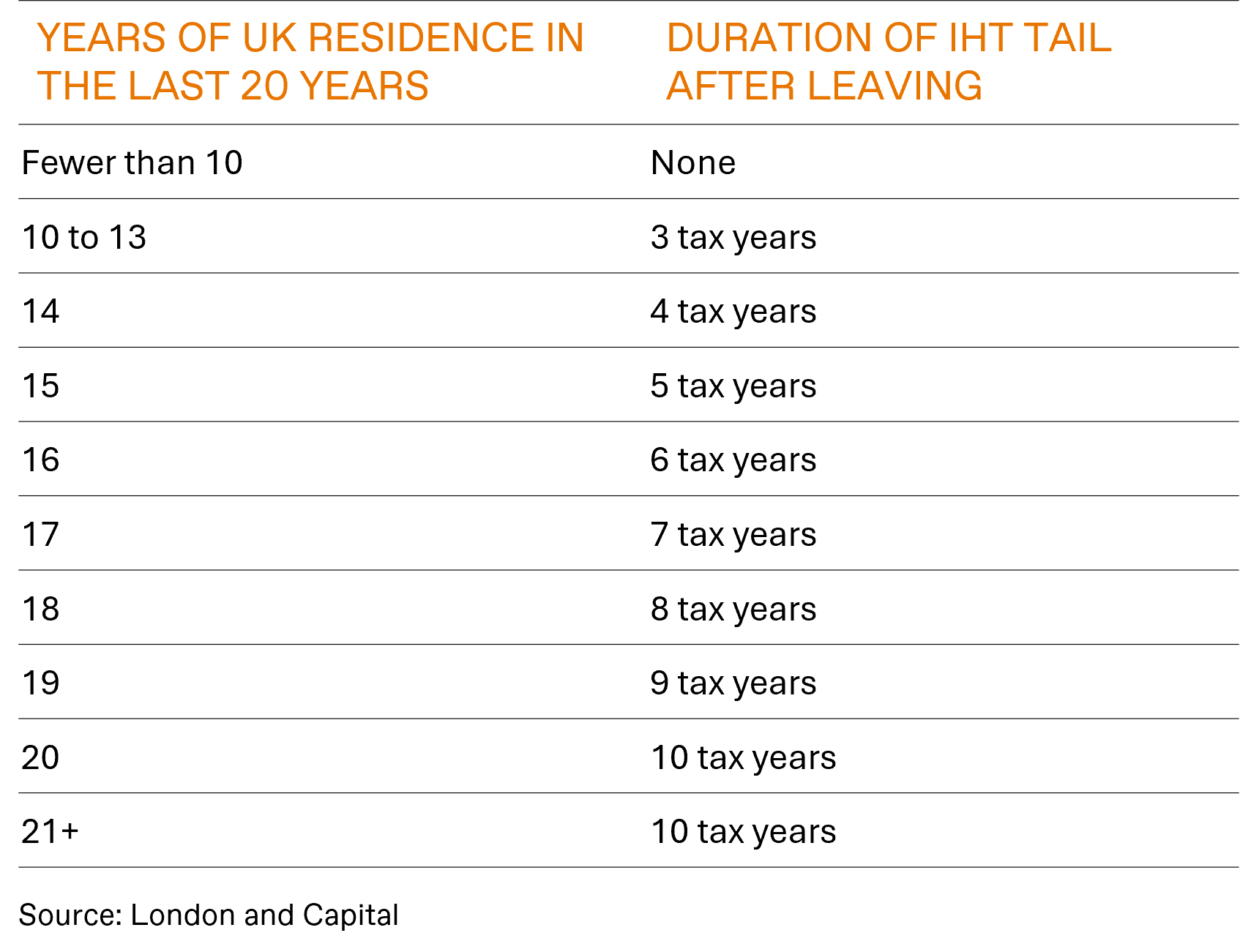

When a long-term resident (LTR) ceases to be UK resident, they often remain subject to UK Inheritance Tax for a period after leaving. This period, often referred to as the “IHT tail,” can last up to ten tax years, depending on how long the individual was resident in the UK before their departure.

The Duration of the IHT Tail from April 2025

The length of the IHT tail is determined by how many of the preceding 20 tax years the individual was UK resident before leaving.

Planning Opportunities – During the IHT tail period, the individual’s worldwide assets remain subject to UK IHT. After the tail ends, only UK-situs assets are subject to IHT.

What can be done to reduce this:

- Asset Restructuring: Identify and, if feasible, restructure assets to reduce exposure to UK IHT.

- Managing your day – With the introduction of the Statutory Residence Test (SRT) back in 2013 it has become much easier to manage your day count and be resident elsewhere

- Life Insurance: Life insurance policies can provide funds to cover potential IHT liabilities during the IHT tail period.