The role of a good asset manager is to protect and grow a client’s money. An obvious statement maybe, but one worth making – particularly when it comes to discussing equities. Stocks are often the most glamourous, headline-grabbing part of the investment universe. They loom large in the public imagination and feature heavily in popular culture. The stories we tell about companies and stocks are the core appeal of the asset class, but these same simple narratives can obscure the complexity and variety of the broad market.

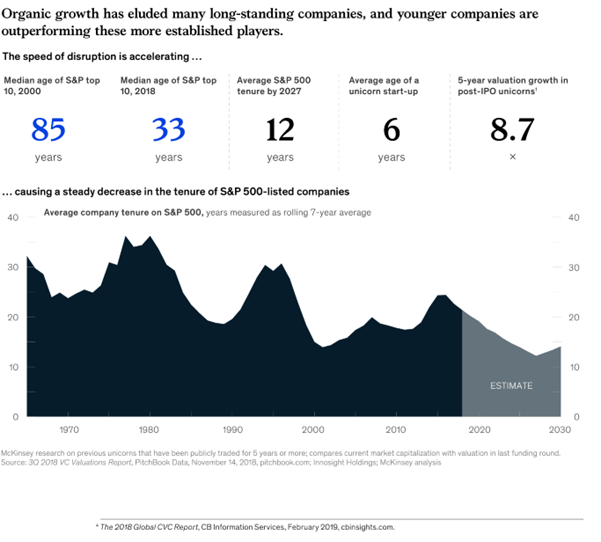

When discussing any asset class, it is always useful to first look at its mechanics. An equity investment represents part ownership of a company. There are typically two ways of profiting from this fractional shareholding: the first is when the value of the company grows over time and the second is if the company distributes profits in the form of cash dividends. Risk in equity investing comes from the possibility that the value of the company, perceived or actual, could fall or that profits, and therefore dividend distributions, are lower than expected or stopped completely. The equities universe is wide and varied, consisting of low-risk, more predictable companies and higher risk, more volatile investments, plus everything in between. Delivering a real return is not a sure thing in the world of stocks and shares. Even the most established companies can experience a meaningful change in the value of their business as market conditions or business models change. We can see this in the market data, with the average tenure of S&P 500 listed companies around 20 years today – down from 35 years in the 1980’s – as ‘disruptors’ continue to increase the pace of change:

Not all equity investments are created equal and the wave of innovation we’ve seen in the past two decades compounds the challenge

At London & Capital, our core equities investment philosophy is underpinned by long-term thinking and a focus on quality assets with a high degree of predictability. Investing in quality companies at reasonable price should produce solid long-term returns for investors. We believe that investing in sound business fundamentals benefit our institutional clients and ultimately shield them from the equity market’s choppiest waters.

Star quality

Taking a closer look at the London & Capital US STAR Equity Portfolio is a useful way of illustrating how we put this investment philosophy into practice. The portfolio consists of US large cap stocks with strong franchises, stable earnings, meaningful free cash flow and solid balance sheets. The companies that make up the portfolio are likely to be more resilient to market declines. As of December 2023, the holdings included US household names such as Microsoft, Starbucks, PepsiCo and Texas Instruments amongst others. Plentiful liquidity in these sort of stocks allow for greater portfolio flexibility, which is paramount in times of market stress

No-one can ever guarantee certainty in investing, but we have designed the US STAR Equity Portfolio to protect and grow Client assets over the long term, avoiding the temptation to chase the latest market narrative or value momentum over quality.This even-handed approach particularly resonates for institutional investors, such as insurers where the responsible management of investment risk is pivotal to a healthy business.

Peaks and troughs in perspective

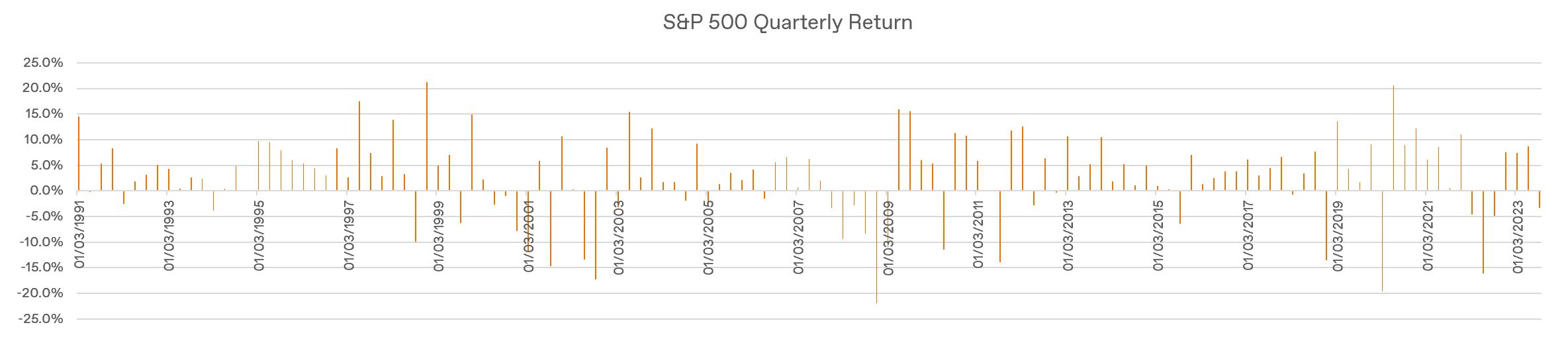

We can see the value of long-term investing, rather than short-term trading, by looking to some of the most well-known equity indices. Look at the long-term graphs of the FTSE 100 or the S&P 500 and it’s the big dips you notice first:

The bursting of the dotcom bubble, the global financial crisis and the spread of Covid-19 have all pushed asset prices south for short periods. But as you zoom out and take in the longer-term trend, a different picture emerges.

Over the last 20 years, the S&P 500 Index has seen a roughly 3000-point rise (returning almost 400%). Actively managing risk during bouts of volatility will always be important for institutions, particularly where there are specific liquidity requirements or business needs. Risk appetites and priorities will always differ but for those that can stay the course, the rewards can be plentiful.

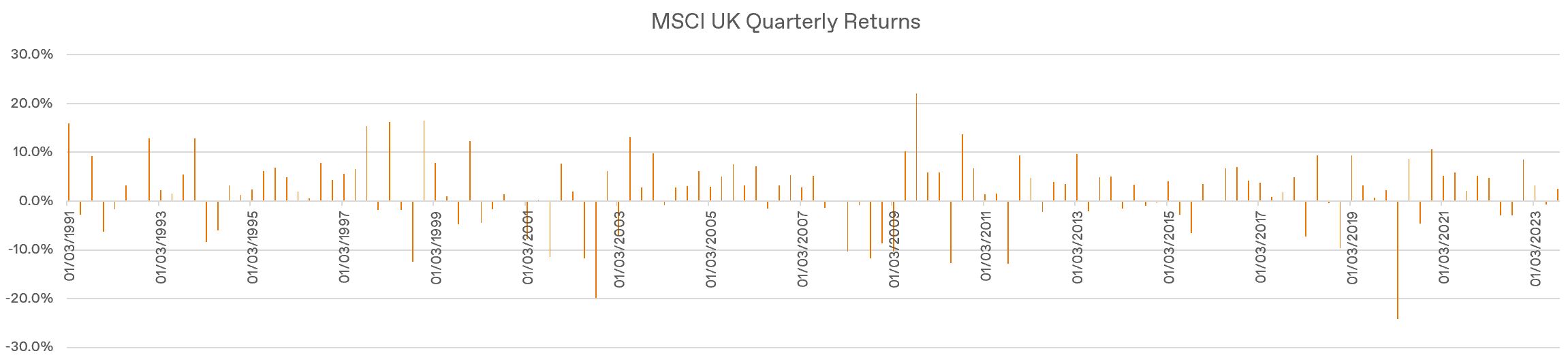

Long-term planning is crucial to managing that dynamic. However, investing in a diversified strategy with resilient business franchises that have stood the test of time, will also be vitally important in delivering long-term returns:

At London & Capital, we provide our clients with a clear understanding of how we are putting their money to work. Investing in quality companies for the long term is at the core of our equity investment strategy for institutions, and something we believe will continue to deliver value for Clients regardless of the short-term market outlook.

Please get in touch with our expert team if you would like to hear how we can work with your business to create and manage a long-term investment strategy.